Domestic order is for. Internal orders

1C UPP provides flexible settings for parameters of any type of accounting, with which you can fully configure the accounting rules in accordance with which the organization operates.

In order to take into account all the nuances, we recommend that at the stage of the pre-project survey, the accounting parameters are fully specified and agreed upon with key users. Firstly, this can serve as a solid basis for building a truly effective system (since regulated accounting has strict rules, and management reflects the real state of affairs in the enterprise), and secondly, it will avoid problems with implementation and discrepancies in data between the old and a new accounting system.

In this article we will take a detailed look at setting up the parameters of regulated types of accounting – accounting and tax.

Access to setting up accounting parameters

Let’s log in with administrator rights and switch to the “Accounting and Tax Accounting” interface.

Figure 1. Working in the interface with administrator rights

After changing the interface, an additional section “Accounting Settings” will appear in the top menu, in which you need to select the “Accounting Parameters Settings” item.

Figure 2. Settings tab

A window will open in which all parameters available for configuration are logically grouped into sections. Let's take a closer look at the parameters and settings for each section.

Section "Production"

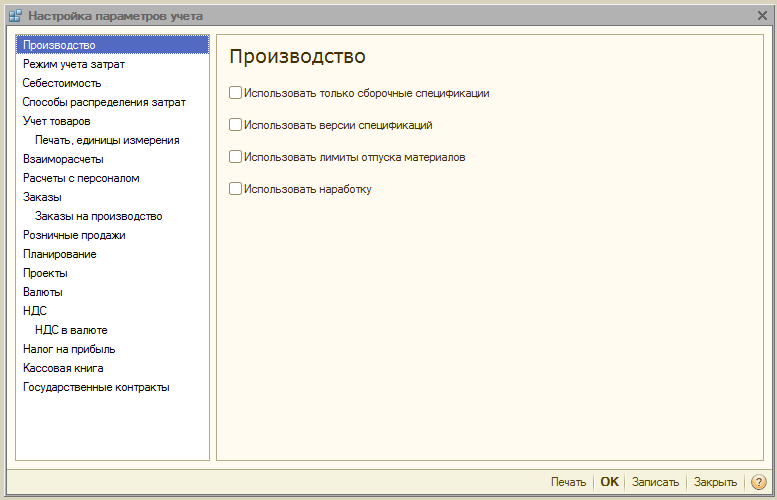

In the “Production” section, the rules for drawing up production documents are indicated:

- Use assembly specifications only– by activating the parameter, users will be able to set the view to “Assembly”. A disabled flag makes additional specification types available – “Full”, “Node”. If you do not plan to use them, it is better to set the flag to avoid user errors in document preparation.

- Specification versions– if the flag is enabled, users will be able to specify different versions in the item specification; if disabled, then each specification can have only one version.

- Use material issue limits– when the flag is turned on, the ability to work with the functionality of limit-fence cards is activated. It is better to uncheck the flag so as not to overload the configuration with redundant, unnecessary functionality when this is not practiced at the enterprise.

- Use operating time– when the flag is turned on, the ability to set the output type “Working hours” in the “Production report for a shift” is activated. If this is not practiced at the enterprise, it is better to remove the flag so as not to overload the configuration with redundant, unnecessary functionality.

Figure 3. Settings for accounting parameters “Production”

Figure 3. Settings for accounting parameters “Production”

Section "Cost Accounting Mode"

The 1C UPP system provides modes "Advanced Analytics", or "Part accounting"*.

The first of them is better suited for production, because allows you to take into account all production costs and inventories on all accounting accounts separately for regulatory and management accounts. At the same time, users have the opportunity to receive detailed analytics on the movement of items and costs. When selecting this mode, the chronological order of document entry is not taken into account.

The second is more suitable for trading companies, for which it is important to accurately determine the cost of a specific batch and see the gross profit from sales in real time.

Figure 4. Cost accounting mode settings

Figure 4. Cost accounting mode settings

*Setting the modes is described at the top level, since this is a separate, large topic. For example, in RAUZ you can configure the detailing, and in batch - the order of write-off.

Section "Cost"

This indicates the type of prices at which the cost is taken into account. The information register “Item prices” must first be configured.

Next, check the boxes for management or regulatory accounting separately. It is used if different warehouses of the same company have different business conditions. In this case, total and batch accounting will be maintained for each warehouse separately. When the option is not activated, the calculation is made for the company as a whole, regardless of the specific warehouse.

Figure 5. Cost settings

Figure 5. Cost settings

Section "Methods of cost distribution"

These settings are used in the advanced cost accounting analytics mode.

If you still want to enable this setting, you should set the rules for calculating the base on the “Distribution Base” tab, within the framework of which the distribution base will be calculated, and you will also select a strategy for calculating the share of costs for each type of product depending on the volume of output, sales volume , occurrence of certain raw materials, according to standards, or manually.

You can distribute costs by type of production: for your own products, products of a third-party processor, products from customer-supplied raw materials, for operating time, for individual departments, for a percentage or for a coefficient.

Figure 6. Settings for cost distribution methods

Figure 6. Settings for cost distribution methods

Section "Goods Accounting"

- Activation of the first group adds the corresponding lines in documents and reference books for accounting according to specified characteristics, as well as for processing transactions with containers.

- The second group is responsible for the ability to work across several warehouses in the tabular part of the selected document.

Figure 7. “Goods Accounting” settings

Figure 7. “Goods Accounting” settings

Section “Printing, units of measurement”

This section is intended for customizing the appearance of printed forms of documents. It is possible to display an additional column with the desired parameter, for example, product code or article number, as well as specify the unit of weight and unit of volume for use in the product characteristics.

Figure 8. “Print, units of measurement”

Figure 8. “Print, units of measurement”

Section "Mutual settlements"

Here, uniform rules for debt control and banking documents are established:

- Way to control days in debt on calendar or weekdays.

- Posting a document based on registration time– the document will be posted at the same moment when confirmation of the transaction is received from the bank. Preferable when you need to track payments from customers in real time.

- At the end of the day of registration date In general, it reduces the system load; it can be used when it is not enough to receive payment reports promptly.

Figure 9. Settings for accounting parameters “Mutual settlements”

Figure 9. Settings for accounting parameters “Mutual settlements”

Section "Settlements with personnel"

The section is intended for setting up filling in the details “Employees” and “Type of wage accrual” in transactions. If you select the “For each employee” option, you will need to fill out these details for each employee. When you select the “Summary...” option, these details are not included in the transactions.

Figure 10. Personnel calculations

Figure 10. Personnel calculations

Section "Orders"

Here you can configure work with orders.

- Auto-reservation strategy specifies the procedure for reserving goods based on customer orders.

- Activation “Indicate orders in the table section” displays an additional column in the receipt and sales documents, which displays the order number.

- Use internal orders activates the functionality for creating internal orders as a separate document with an identical name. If the company does not use a system of such orders, it is better to disable the flag so as not to burden users with redundant information.

- Specify series when making a reservation of goods in warehouses allows you to take into account series (only subject to a reserve for orders indicating the counterparty agreement, in which the attribute “Separate accounting of goods according to buyer orders” is set).

- Account for customer returns– when the flag is turned on, the weight of ordered goods changes automatically when posting “Return of goods from the buyer”.

Figure 11. “Orders” settings

Figure 11. “Orders” settings

Section "Orders for production"

The section is intended for setting parameters for working with production orders.

When the flag is enabled "Use production orders" The additional document “Production Order” becomes available.

Enabling the following flag makes it possible for each order to calculate the requirements for materials and semi-finished products for the production of finished goods.

Closing needs can be implemented in one of two modes:

- Obviously– using the document “Adjustment of production order”. They are also completely closed when conducting the “Production Report for the Shift”, “Item Assemblage” and “Act on the Provision of Production Services”, if all goods have been released according to the order.

- Automatic– that is, when dividing materials into the release of goods, as well as when registering it using “Item Assemblage”.

Figure 12. Production orders

Figure 12. Production orders

Section "Retail sales"

Designed to configure retail sales parameters:

- Possibility of payment by payment cards, bank loans;

- Accounting for the sale of alcoholic products;

- The procedure for sending electronic checks to the buyer.

Figure 13. Retail sales

Figure 13. Retail sales

Section "Planning"

The section is designed to configure planning parameters:

- Frequency of access to key resources specifies the time interval in which planning is carried out: day, week, decade, month, quarter, half-year, year.

- Perform shift planning– when activated in specifications and production orders, the shift planning mechanism becomes available.

Figure 14. Scheduling settings

Figure 14. Scheduling settings

Section "Projects"

Here you can configure accounting in the context of Projects.

- Keep records of projects– activates additional detail on projects for sales, purchases, cash flows, costs and planning.

- Use distribution types by project– when the flag is enabled, additional tools are activated for allocating basic costs to projects.

- Keep track of project costs– activates the posting of indirect costs across projects.

- Indicate projects in the tabular part of documents– in documents reflecting financial transactions, an additional column “Project” becomes available, in which you can indicate which specific projects the costs relate to.

Figure 15. “Projects” accounting parameters settings

Figure 15. “Projects” accounting parameters settings

Section "Currencies"

Here you can configure the currencies used for accounting*, management and IFRS accounting.

*Regulation currency is the base currency, its rate is always equal to 1 (for the Russian Federation - ruble).

Figure 16. “Currency” accounting parameters settings

Figure 16. “Currency” accounting parameters settings

Section "VAT"

The section is intended for setting up the numbering and printed forms of invoices. It is possible to indicate the full or full and abbreviated name of the seller, as well as set a separate numbering for invoices for advance payments.

Figure 17. Settings for VAT accounting

Figure 17. Settings for VAT accounting

Section “VAT in currency”

The section establishes the method for calculating the VAT amount for documents in foreign currency. When choosing the option “By the ruble amount of the document”, the VAT amount will be calculated by multiplying the ruble amount by the VAT rate.

When choosing the option “By currency amount of VAT”, the ruble amount of VAT is calculated by multiplying the currency amount of VAT by the document exchange rate.

Figure 18. Settings for accounting parameters “VAT in currency”

Figure 18. Settings for accounting parameters “VAT in currency”

Section "Income Tax"

The income tax is set up for property and services pre-paid under an agreement in foreign currency and the rules for supporting PBU 18/02 when taking into account amount differences when payment is received under agreements in cu. after transfer of ownership.

Figure 19. Settings for accounting parameters “Income tax”

Figure 19. Settings for accounting parameters “Income tax”

Section "Cash Book"

This section allows you to configure options for maintaining cash books: for separate divisions or for the organization as a whole.

When the flag “Use maintenance of cash books by separate divisions” is enabled, the subaccount type “Divisions” will be added to accounts 50.01 and 50.21; when the flag is removed, the subaccount type will be deleted and the process will be possible only for the entire organization as a whole.

Figure 20. “Cash Book” accounting parameters settings

Figure 20. “Cash Book” accounting parameters settings

Section "Government contracts"

The section is intended for setting up additional functionality for accounting for payments under government contracts.

When the flag is turned on, it becomes possible to work with objects of the “Government Contracts” subsystem. For a bank account, counterparty agreement and applications for spending funds, you can establish compliance with a government contract.

For Settings for uploading supporting documents the directory for uploading supporting documents when exchanging with the bank is indicated, as well as the maximum size of the supporting document file (MB) and the supporting document archive file (MB).

Figure 21. Accounting settings “Government contracts”

Figure 21. Accounting settings “Government contracts”

This completes the review of accounting parameters settings in the 1C UPP system. For more detailed information about the system capabilities and configuration rules, you can contact our consultants.

Just like a buyer's order and an order to a supplier, the concept of an internal order characterizes the intention or agreement with the enterprise to receive a list of goods. But such an agreement is exclusively internal; the order can only come from internal divisions (departments) of the enterprise. In this regard, when executing internal orders, unlike orders to suppliers and orders from customers, there is no payment component; when an enterprise fulfills an internal order, the division (department) does not pay the enterprise in any way for this, even at transfer prices. Internal orders are most often associated with providing departments with goods or materials necessary to conduct their main activities. For example, these could be orders from retail outlets to receive products from central warehouses for further trade, orders from production departments to receive spare parts for equipment, orders of materials or goods to maintain safety stock in warehouses. For each internal order, the system maintains an automated record of the order fulfillment status. And depending on how the internal order was executed, who acted as the customer, certain events can be considered the fact of completion. In general, working with internal orders has many similarities with working with customer orders. There are also differences in accounting for internal orders and customer orders, due to the different nature of the occurrence of orders, here are just a few of them:

· there is no payment component in the execution of internal orders, which is why there is no data on prices and discounts when placing an internal order, and the buyer’s order must be shipped and paid for, the buyer’s order is associated with the pricing subsystems of mutual settlements;

· as a result, an internal order is taken into account only in quantitative terms, and a buyer’s order is taken into account in both quantitative and cost terms;

· in the internal order only commodity and material assets are indicated, services are not indicated, and in some cases, returnable packaging is not indicated;

· internal orders do not detail costs, including production costs;

· For internal orders, separate records of consignments of goods are not maintained.

For example, if an internal order is placed for goods to maintain inventory in the workshop storerooms, then it may still be worth specifying not the production department to which the workshop pantry belongs, but rather the warehouse that describes the workshop pantry. An internal order specifying a department is most often used to plan the material requirements for production within the work of that department. The fact of execution of such an internal order will precisely coincide with the transfer of the ordered goods into production at this division

Shipping date

Just like for a customer order, the shipment date in an internal order is optional information; it is used later in a number of cases to select internal orders, namely:

· when forming sales, production and purchasing plans, when the setting for automatically filling out the tabular part of documents is used;

· the shipment date in the internal order is used in the algorithms for automatic order placement in orders to suppliers;

· customer orders can be used to formulate the requirements for materials or goods necessary to implement a production program or sales plan. Orders act as a source of requirements; if the orders indicate a shipment date, then the volume of calculated requirements for fulfilling the order will be planned for the date preceding the date of shipment of the order. This means that all materials or goods must be in stock the day before the order itself is shipped.

Features of filling out an internal order

Type of customer: department or warehouse

Goods specified in an internal order can be delivered to a specific warehouse or transferred to a department of the enterprise. The choice of warehouse or department is carried out in the order form itself. From this point of view, we can say that either a warehouse or a department can act as a customer in internal orders. If a warehouse is selected, the order will be considered completed if the ordered goods are delivered to this warehouse. Moreover, any type of warehouse, including a non-automated retail outlet, can act as a warehouse. If a department is selected, the order is considered completed when the goods are transferred to this department. It is important to note that the internal order is purely a management document, despite the fact that it specifies the organization. The customer division is selected from among the divisions of the enterprise, and not from the divisions of the organization.

What can you order in a domestic order?

In an internal order, unlike a customer order, only inventory items are specified, and services are not specified. If a warehouse is selected as a customer, the “Products” and “Containers” tabs become available in the document. If an order is placed for the transfer of goods to a department of the enterprise, then the container is not indicated in the order.

An internal order can be fulfilled by:

· current balances of goods and products in the company’s warehouses, which can be reserved for order;

· production of products in-house or by a third-party processor;

· purchasing products from other suppliers.

Reserving goods for internal orders is carried out according to the same laws as reserving goods for customer orders.

Let's look at the custom production scheme using a specific example.

Diana LLC carries out production activities, collecting production costs based on customer orders. The value of inventories is assessed at the average cost. Product output is reflected at planned prices without using account 40. When distributing costs, general business expenses are included in the cost of finished products. To account for costs in the 1C: Manufacturing Enterprise Management software, the organization uses the “Batch Accounting” mode.

On January 1, 2013, Diana LLC received an order for the supply of “Product 1” in the amount of 1 piece from buyer E. I. Zamyatin. at a price of 10,000 rubles. (VAT=18% on top).

On 01/02/2013, an order was received from the buyer LLC “When the Sleeper Awake” for the supply of “Product 2” in the amount of 1 piece. at a price of 20,000 rubles. (VAT=18% on top).

To manufacture products in accordance with the standards, the following is required:

On January 02, 2013, the following materials were received from the supplier Brave New World LLC to the materials warehouse:

- On January 02, 2013, the materials required by the standards were written off for the production of semi-finished products in workshop 1.

- 01/08/2013 Zamyatin E.I. and LLC “When the Sleeper Awake”, the ordered products were shipped.

- On January 16, 2013, the supplier CJSC “Clockwork Orange” issued an invoice for the rental of workshop premises in the amount of 5,500 rubles.

- On January 31, 2013, the team of workers was paid a salary of 7,500 rubles:

- 1,500 rub. for the release of semi-finished product 1 (for finished product 1);

- 2,500 rub. for the release of semi-finished product 1 and semi-finished product 2 (for finished products 2);

- 1,750 rub. for the release of finished products 1;

- 1,750 rub. for the release of finished products 2.

The costs of depreciation of machines in the amount of 2,200 rubles were also collected. The administration salary was accrued in the amount of 5,500 rubles.

Let's consider how the collection of costs for the production of products for a specific order, as well as the production of products and the distribution of costs is reflected in the document “Cost Cost Calculation”.

Entering regulatory data in specifications

Since the standards for the consumption of raw materials are known for the production of products, on the basis of which write-offs will be made, it is necessary to enter this information into the system. Standards are entered in the “Nomenclature Specifications” directory. The convenience of using specifications lies in the fact that with the help of specifications you can automatically fill out documents for writing off material costs and distributing materials to manufactured products, which significantly speeds up the user’s work and avoids a number of errors.

It is more convenient to enter specifications through the item card, for which the standards for writing off raw materials are set. In our case, specifications must be entered for two types of products and two types of semi-finished products.

In the item card on the “Additional” tab, in the “Type of reproduction” field, you must specify the “Production” option. When selecting this option, the “Specifications” tab becomes visible in the item card, and the user has the opportunity to enter specifications.

On the “Specifications” tab, click the “Add” button to add a new specification:

In the specification window that opens, you must specify:

- Name: for the convenience of the user, the name may indicate the distinctive features of the specification. For example, if 2 write-off options are used to produce an item: one using “Material 1”, and the second using “Material 2”, then in the name of the specification the user can indicate “Product 1 (material 1)”. In our case, the name of the specification will coincide with the name of the item.

- Quantity: indicates the quantity of manufactured products for which production standards are set (if the standard is set for 2.16 pieces of manufactured products, 2.16 must be specified in the “Quantity” field).

On the “Initial components” tab, a list of materials used with indicators of standard write-off is indicated:

- nomenclature;

- quantity.

To automatically fill in the “Cost Item” field in the tabular part of the “Requirement-Invoice” document in the specification card, you must fill in the “Cost Item” field.

The remaining indicators on the “Initial components” tab are not required to be filled out: they are required to automate the “Production planning” block.

After filling out the “Initial components” tab, go to the “Advanced” tab and be sure to set the status to “Approved”. It is not necessary to adjust the approval date (by default, the program sets this date equal to the current one), it does not affect the reflection of transactions:

To put a specification into effect, it is necessary to set the flag in the “Active specification” field.

If it is necessary that, when releasing a product, the specification is automatically inserted into the tabular part of the “Shift Production Report” document, you should select the main specification, which the program itself will “pull” into the release documents. To do this, click the “Set” button in the specification header to set the date from which this specification will be considered the main one for the selected item:

Specifications can be entered using the “Specification Designer” processing, which allows you to analyze the general structure of material costs for production:

In the “Specification Designer”, the amount of materials required for the production of a semi-finished product, in our case, is reflected per unit of produced semi-finished product: please note that for the production of “Product 1”, 1.16 kg of semi-finished product 1 is required, and the amount of materials for the production of a semi-finished product is reflected in per 1 kg. The quantity of semi-finished product for which the material write-off standard is reflected depends on the quantity specified in the specification card.

Entering data on customer orders

The buyer's order is reflected using a document with the same name. The header of the document indicates the counterparty and the agreement under which the shipment will be made. In the tabular part of the document on the “Products” tab, the ordered products are listed indicating the quantity, price and VAT rate:

Information about all received and unfulfilled orders is reflected in the “Analysis of Customer Orders” report:

Placing customer orders in production orders

To keep track of the collection and distribution of costs based on customer orders, the customer order must be linked to a production order. In this case, a production order will act as an additional analytics for collecting costs, producing products and will allow you to analyze the cost of manufactured products in the context of production orders.

The “Production Order” document can be entered automatically based on the “Buyer’s Order” document or manually (but using the “Fill in/Fill in according to the customer’s order” button above the tabular part of the document):

On the “Products” tab, the document lists the products that need to be produced according to the buyer’s order.

The “Materials” tab is also filled in automatically by clicking the “Fill” - “Fill according to specification” button. This tab displays the list of materials and semi-finished products required for the production of products.

note that the program does not automatically completely explode the product, but provides a list of required semi-finished products (if any).

Based on the created production orders, you can generate a report reflecting information about the list of products that need to be produced for specific orders:

Note! For product release 1, we created a production order No. 1, for product release 2, we created a production order No. 2.

When filling out the “Launch” and “Execution” details in the “Production Order” documents, the “Production Order List” report allows you to group information with the output of the planned production start date and execution date:

To produce semi-finished products required for production, it is also necessary to create “Production Order” documents.

We will create orders for the production of semi-finished products. The header of the document indicates the main production order (order for the production of a finished product). The tabular part of the “Products and Services” tab is filled in automatically by clicking the “Fill” button - “Fill in according to the production order.” The window for selecting a production order opens. When selecting an order, the program automatically analyzes the “Materials” tabular part of the selected main order and selects those item items that have the reproduction type set to “Production”. This list of items is transferred to the “Products and Services” tabular part of the new order.

After filling out the first tab, you need to fill out the “Materials” tab. Click the “Fill” button - “Fill according to specification”. The amount of materials required for the production of semi-finished product 1, indicated on the “Products and Services” tab, is automatically calculated.

In a similar way, a document “Order for production” of semi-finished products used for production is created:

note, that filling out the tabular part for a production order is possible only if in the “Accounting Parameters Settings” the flag in the field “Keep records of the requirements of production orders for materials and semi-finished products” is set:

The “Materials” tab is filled in with a list of required materials automatically by clicking the “Fill” button. The materials required for the production of semi-finished products are listed here.

Inventory receipt

The receipt of materials is reflected in the document “Receipt of goods and services” with the transaction type “purchase, commission”. Since in our example the receipt is carried out without reference to a specific document “Order to supplier” and “Order to buyer”, we leave the fields “Order to supplier”, “Order” in the tabular part of the document and the field “Order to supplier” in the document header blank:

Collection of material costs for production

To write off materials, use the “Request-invoice” document.

It is possible to automatically fill the tabular part of the document with a list of materials specified in the specification. For this purpose, use the “Selection” button above the tabular part of the document on the “Materials” tab:

In the processing form that opens, in the “Selection” field, set the “By specification” option. In the list of specifications, select the required one and double-click on the selected specification to fill out the tabular part of the document.

note that in the selection form you can set the flag in the “Request quantity” field, then when you select a specification according to which the tabular part of the document is filled out, the program will issue an automatic request to indicate the quantity of the output product for which materials need to be written off. Otherwise, the user will have to recalculate the quantity manually and indicate the required quantity in the tabular part of the document.

When filling out the “Demand-invoice” document, the user must indicate the warehouse, management and regulated accounting department in the header of the document. All fields of the tabular section (except for the “Analytics” and “Orders” fields) are automatically filled in with information from the specification card:

The collection of costs must be carried out in the context of production orders, therefore, in the tabular part of the document, it is necessary to indicate the order at the cost of which the materials are written off. Since the production of semi-finished products is carried out according to orders created for each semi-finished product, in the tabular section in the “Order/Costs” field you need to select an order for the production of a specific semi-finished product.

In the “Analytics” field, the item group is indicated. Nomenclature group is an analytical section for accounts 20, 23, 28, 29, 90. In the context of item groups, costs are collected, product output is reflected, sales revenue is collected and the cost of production is determined.

Let us divide the production of semi-finished products and finished products into two product groups - “Semi-finished products” and “Finished products”.

For the production of “Product 1” and “Product 2”, semi-finished product 1 is required. For each product and semi-finished product in our example, a separate production order was created, therefore, when writing off materials, it is necessary to link the write-off to a specific order. When automatically selecting items in the “Request-invoice” document, the program does not add new lines to the tabular part, but sums up the quantities in the existing ones, if the same material is used for several specifications, therefore, for ease of filling out, we will create our own document for each semi-finished product produced “ Request-invoice."

For the release of product 1, the release of semi-finished product 1 is required. Let's create a document "Requirement-invoice" for the write-off of materials according to the specification created for semi-finished product 1. As an analytics, we will indicate order No. 3 - an order for the production of semi-finished product 1:

For the production of products 2, the production of semi-finished products 1 and 2 is required. We will create a separate document “Requirement-invoice” for the write-off of materials according to the needs specified in the specifications created for semi-finished product 1 and semi-finished product 2. As a cost analytics, we will indicate order No. 4 - an order for the production of a semi-finished product 1 and semi-finished product 2:

note that in the results of the document “Request-invoice” we will not see for which order the materials were written off:

In which reports can I see information about write-offs made by production orders? To analyze the collection of costs, two standard reports are intended (in fact, there are more reports with which you can perform the analysis, but we will consider the most frequently used ones): “Statement of production costs” (accounts 20, 23, 29) and “Statement of costs" (counts 25, 26, 44).

Let’s add the “Order” indicator to the report settings. Regardless of the fact that this indicator is not reflected in the balance sheet, we can always see in the balance sheet whether it was linked to a specific order.

This report reflects information not only on material write-offs, but also on the collection of intangible costs (wages, depreciation, services, etc.).

In our case, materials are written off for production on 01/02/2013, however, for the convenience of the user (as enterprises often do), materials can be written off at the end of the month (for example, on the last day of the month). The date of write-off of materials does not affect the formation of postings for product release (the release may be reflected earlier). The cost of written-off materials will be distributed at the end of the month using the “Cost Cost Calculation” document, which will take into account all documents entered during the month, regardless of whether the issue is reflected before the write-off or not.

Reflection of the release of finished products and semi-finished products

To reflect product output, the document “Production Report for a Shift” is used. To indicate the production order for which the products are produced, you need to configure the document. The “Settings” button opens the document settings window, in which you need to set the “Use orders” flag, which will allow you to indicate production orders in the tabular section. We will also set the flag “Use materials” and “Automatically distribute materials” to automatically distribute materials for production according to selected specifications in the context of production orders:

The header of the document indicates the warehouse to which the products are released and the department that produced these products. The tabular part on the “Products and Services” tab lists the list of released semi-finished products, reflects the volume of output and output analytics.

What analytics is important to indicate in the “Shift Production Report”?

- nomenclature group;

- production order;

- specification.

note that in the “Orders” section in the tabular part of the document there are 3 columns:

- Expenses.

- Release.

- Reserve/Accommodation.

The “Costs” field is used to indicate the order for which product output is analyzed (the “Product Output (Cost Estimation)” report). Also, using this information, the cost of production is calculated. And costs should be collected accordingly. The “Cost” field must be filled in when producing semi-finished products, so that when calculating the cost, the cost of semi-finished products is calculated in the context of production orders

The “Release” field is used to indicate the order for which the production order fulfillment is analyzed (the “Production Order List” report). The “Release” field is filled in at the moment when finished products or semi-finished products are released for a specific order (in this case, the system will understand that the production order is closed)

The Reserve/Allocation field is used to indicate the order for which the issue is reserved.

note to fill out the “Orders” section when producing semi-finished products in our example. Semi-finished product 1 in the amount of 1.16 was released under production order No. 3. Under production order No. 4, semi-finished product 1 and semi-finished product 2 were produced in quantities of 3.4 and 1 piece. respectively.

The “Materials” tab is filled in with a list of materials that were required to produce the product. Filling can be done automatically using the “Fill” button or manually. Let's fill out the tabular part “according to the specification” (Fill in/Fill in according to the specification). Since the “Automatically distribute materials” flag is set in the document settings, when posting a document, the program itself will distribute the written-off materials (listed on the “Materials” tab) to the semi-finished products released in this document. The distribution will be carried out in accordance with the standards laid down in the specifications of the released products (semi-finished products).

To analyze the output of semi-finished products, we will use the “Product Output (Cost Estimation)” and “Output Costs” reports, detailing them down to production orders.

The report “Product Output (Cost Estimation)” reflects a list of products released at planned prices during the month. If prices are not specified in the “Setting Item Prices” document, then product output (including generated postings Dt 21 Kt 20) is reflected at zero cost (as happened in our example with semi-finished products).

At the end of the month, when calculating the cost, production output at planned prices will be adjusted to actual figures and the report will reflect the actual cost of production, taking into account all costs.

Using the “Output Costs” report, you can analyze the cost of manufactured products (semi-finished products) in terms of cost items (tangible and intangible), as well as in terms of materials used for production. The cost indicators in the report are formed when calculating the cost price. Quantitative indicators can be generated both when calculating the cost price and during the month if the user enters distribution documents: “Distribution of materials per output”, “Distribution of other costs”, “Production report for the shift” (when distributing materials in the output document).

In our example, materials are distributed for the production of semi-finished products when posting the “Production Report for a Shift” document. Therefore, we can see quantitative indicators in the report before conducting the “Calculation of production cost” document.

On 01/05/2013, both semi-finished products were produced in workshop 1 and written off together with the required materials for the production of finished products in workshop 2.

When writing off semi-finished products and materials for the production of finished products, we will use the “Selection” - “By specification” button. Please note that item accounting accounts are installed automatically (if there is a completed information register “Item Accounting Accounts”), and the “Analytics” (Item Group) and “Warehouse” fields must be filled in manually. Since the semi-finished products were released to the finished products warehouse, and the materials are stored in the materials warehouse, when filling out the “Demand-invoice” document, we will not indicate the warehouse in the header of the document, but fill in the “Warehouse” field in the tabular section.

note, that now the write-off of materials and semi-finished products is carried out according to the product group “Finished Products”.

We also link the write-off to a specific production order:

For the production of product 1 according to production order No. 1, we write off the amount of materials specified in the order itself:

For the production of product 2 according to production order No. 2, we write off the amount of materials specified in the production order No. 2:

On January 07, 2013, finished products were released to the finished goods warehouse.

Let us reflect the output of product1 and product2. To do this, we will create a document “Production report for the shift”.

When reflecting product output in the “Production Report for a Shift” document, similar to the previously discussed example with the release of a semi-finished product, the “Products and Services” and “Materials” tabs are filled in.

On the “Products and Services” tab in the “Orders” section, the “Cost” and “Output” fields must be filled in, which indicate the order for the production of finished products. The “Reserve/Placement” field can also be filled in: in this field we indicate the buyer’s order for which the products are being produced. When this field is filled in, shipment of goods is possible only for this order (the mechanism for reserving goods is launched).

After posting the document, the report “Product Output (Cost Estimation)” will reflect the quantity of products produced in the context of production orders:

Reflection of sales of products under the buyer’s order

The shipment of finished products is reflected using the document “Sales of goods and services”. The header of the document must indicate the buyer's order, on the basis of which the production order was created and the collection of costs and production of products was reflected. The tabular part of the document is filled in automatically using the command “Fill in/Fill in according to the buyer’s order (invoice for payment).” At the same time, the tabular part of the document lists all the products specified in the “Buyer’s Order” document. When automatically filling out the tabular part of the document, the “Buyer’s Order” field is also filled in automatically with the order from the document header. Please note that if a reservation of finished products was made during the release of products, then the write-off method in the sales document should be set to “From reserve” (not “From warehouse”):

Collection of production costs: third party services, payroll

On January 15, 2013, the supplier JSC Fahrenheit 451 issued an invoice for electricity services provided in the amount of 1,000 rubles.

On January 16, 2013, the supplier CJSC “Clockwork Orange” issued an invoice for the rental of workshop premises in the amount of 5,500 rubles. and for office rent in the amount of 3,000 rubles.

Incoming services are reflected using the document “Receipt of goods and services” on the “Services” tab. Since both workshops were involved in the production of products, and the cost of electricity was received as a total amount, we will assign the amount of costs to Workshop 1, and when calculating the cost, we will distribute this amount between both production workshops. We will do the same with the rental of workshop premises: we will collect the costs for account 25 in Workshop 1 and distribute them when calculating the cost between both production workshops according to the base specified in the organization’s accounting policy. Office rental costs will be charged to account 26.

In receipt documents we do not reflect the link to a specific buyer order, since electricity and rental costs must be distributed among all orders.

Add a picture of electricity services. Add a line with office rental costs to the current picture.

On January 31, 2013, the team of workers was paid a salary of 7,500 rubles:

- 1,500 rub. for the release of semi-finished product 1 (for finished product 1 according to production order No. 3).

- 2,500 rub. for the release of semi-finished product 1 and semi-finished product 2 (for finished product 2 according to production order No. 4).

- 1,750 rub. for the release of finished products 1 (according to production order No. 1).

- 1,750 rub. for the release of finished products 2 (according to production order No. 2).

Salary accrual is reflected using the document “Reflection of wages in regulated accounting.” Since wages in our case are calculated for the completion of a specific production order, when registering this operation it is necessary to indicate the production order. The document “Reflection of wages in regulated accounting” does not contain the “Order” field in the tabular part, therefore, to calculate wages, we will use the document “Other expenses”. To calculate wages, the document “Piece work order for completed work” is also used. It would be more correct to use this document, but for example we will use the “Other costs” document:

Also in January, costs for depreciation of machines were collected in the amount of 2,200 rubles. and the administration salary was accrued in the amount of 5,500 rubles.

Depreciation is reflected in the document “Depreciation of fixed assets”. Depreciation will be calculated on account 25 in a ratio of 50/50 for Workshop 1 and Workshop 2. The costs of paying wages to administration employees will be attributed to account 26.

When analyzing both reports, it is clear that costs on account 20 are collected in the context of production orders and item groups.

The collection of costs on accounts 25 and 26 is carried out in our example for an empty order and an empty item group, as a result of which, when calculating the cost, the distribution of costs will be made to all item groups (provided that the user does not limit the list of item groups independently in the "Distribution methods" register cost items of the organization"), for all manufactured products and semi-finished products. If necessary, at the time of collecting costs on accounts 25 and 26, the user has the opportunity to indicate that a particular cost is the cost of a specific item group and/or a specific order.

Calculation of production costs for production orders

According to the accounting policy of the organization, the costs collected on accounts 25 and 26 are distributed to finished products and semi-finished products in proportion to the wages accrued to production workers. Material costs are allocated according to specifications. The wages of production workers are distributed in proportion to the volume of output. The distribution methods must be set up using the information register “Methods of distribution of organizational cost items”:

When “Calculating cost”, all costs collected on accounts 20, 25 and 26 are distributed to the cost of manufactured products and semi-finished products.

At the same time, the costs collected on account 20 in the context of product groups and orders are distributed to the production of products within the same product groups and orders. To confirm, let’s compare what costs were collected on specific orders in the “Production Costs Statement” before calculating the cost, and how they were distributed to product output in the “Output Costs” report. The figure below shows that before calculating the cost of production order No. 1, wage costs in the amount of 1,750 rubles were collected. and material costs in the amount of 8.42 kg (the total figures changed as a result of the fact that the cost of semi-finished products written off for the production of finished products was adjusted to the fact). After calculating the cost, these costs were allocated to the production of products within the same order.

When analyzing the reports “Statement of Costs” and “Costs of Production”, it is clear that the entire amount of costs collected on accounts 25 and 26 by cost items was distributed to all item groups and orders:

As a result of collecting production costs and reflecting the output of semi-finished and finished products in the context of production orders when distributing costs, the user receives the exact cost of each issue within the production order, which allows you to analyze the revenue from sales of products for each buyer and each buyer order:

Let us pay attention to the following point: all collected costs for production order No. 3 were distributed to semi-finished product 1, which was entirely written off to product 1. It turns out that in the statement of production costs the value of all costs (material and

Here is a complete, practical instruction for the production and sale of finished products in 1C “Manufacturing Enterprise Management”. We have created a holistic user drive so that in one instruction you can find answers to all questions related to production, cost and sales. If any question, in your opinion, is not disclosed or is not fully disclosed, please write to us, we will supplement the material with the necessary information.

Let's consider a real example of production based on the production of a company producing entrance doors. In our example, we will produce and sell a door “PVC entrance door (Alder) with lock.” The process consists of links: receiving the buyer’s order, purchasing the necessary materials for production, production itself, sales, summing up the transaction. Based on the business process chain, we sequentially formalize operation after operation. Go.

Implemented on: 1C Enterprise 8.3, configuration “Manufacturing Enterprise Management”, ed. 1.3.

BUYER'S ORDER

Actually, the buyer’s order will be the starting point. Everything is simple here. Accepted, recorded in 1C with the document “Buyer’s Order”, which is in the menu:

Main menu – Documents – Sales management – Buyer’s orderA nomenclature with the name of the finished product is entered into the buyer’s order. You can add regular resale goods into the same order. There are no restrictions on the assortment. After the buyer’s order is approved (paid), you can create a production order based on it. Here and further in the text, when we say what needs to be created on the basis, then you need to perform the action: right-click on the base document, select “Create on the basis” - “Some New Document”.

By default, all items from the customer's order will be added to the production order. Delete the ones you don’t need and post the created “Production Order” document.

ORDER FOR PRODUCTION

If the buyer's order was the starting point for the entire process, then the production order is the start of production. The production order journal can be opened through the main menu:

Main menu – Documents – Production management – Production order

In a production order, it is important to select the specification of the product being manufactured based on the specification and fill out the Materials tab.

Let's take a closer look at what a specification is and why it is needed.

Product Specification– this is a card of manufactured products with a list of materials and other consumables necessary for production.

The specification belongs to a specific product. The function of the specification is to simplify, standardize the production of products and streamline document flow. Maintaining a specification is not mandatory, but it will be faster and easier to produce if the products produced constantly consist of the same materials.

Once a production order has been created, you can begin to analyze the availability of all necessary materials. If there is a need to replenish inventories, purchases are made. The easiest way to understand whether a production order is provided with everything necessary is to reserve for the order everything that is available on current balances, and purchase the rest.

Order supply analysis can be done directly from the order by clicking on the “Analysis” button

As can be seen from the analysis, only electricity is available in the required quantity. All other materials need to be purchased, since they are not available in stock. We purchase the necessary materials.

Purchase of materials and raw materials

The actual purchase of materials is no different from ordinary commodity purchases. All incoming receipts of goods and materials are recorded in the document journal “Receipt of goods and services”, which is located in:

After purchasing the necessary materials, production can begin directly.

PRODUCTION REPORT FOR THE SHIFT

Production involves two things: writing off materials and posting products. This transformation of raw materials, materials, and semi-finished products has its own characteristics in 1C. The first feature is that the write-off of materials and the receipt of finished products is carried out in 1C UPP using two different documents. Production report – finished products arrive. Request-invoice – writes off materials, semi-finished products. The second feature is that the invoice requirement is entered based on the production report for the shift.

So, in order to capitalize the finished product, based on the production order, we create the document “Production Report for the Shift”.

Documents are stored in a journal of the same name, which is accessible through the main menu:

In the “Shift Production Report” document we have several tabs. Briefly about each of them.

Products and services. On this tab, the products that are obtained as a result of the production process are entered. When creating the “Production Report” document, the products tab and the materials tab are filled in automatically from the production order. What is included in the “Products and Services” tab is included in the warehouse as products. For finished products, we recommend creating a separate product group.

Materials. This tab displays a list of write-off materials and other material costs. The entire cost of this tab is transferred by the program to the first tab “finished products”.

Those. Operations. This is an optional tab. Designed to write off additional costs that arose during production. It can also be used to take into account and add to the cost price the piecework wages of workers involved in production. In order to take into account, for example, loading or welding work, it is enough to add this operation with a tariff for work (hour, production of pieces) to the “Technological operations” tab and distribute it among workers.

Performers. This tab indicates the performers of the work specified in the technological operations. If you did not fill out the “Tech. Operations”, then you do not need to fill out the “Performers” tab.

Other expenses. Designed to account for other costs, for example, administrative, sales, security, etc. These costs can also be allocated to finished goods. If you have no additional costs in production, the tab will not be filled in.

A little about the document settings.

There is a “Settings” button in the document header. The checkboxes on this tab help automate the process of cost distribution and transfer them from manual to automatic mode. If you check the box next to one of the lines, a new tab will appear in the document.

REQUIREMENT-INVOICE

It is in 1C “UPP” that the process of writing off balances and posting finished products is divided into two documents. The responsible document for writing off inventory items is the document “Requirement-invoice”. The document is available in the menu:

Main menu – Documents – Inventory management – Request invoice

In order for the cost of write-off materials to be correctly written off to finished products and included in production costs, it is necessary to create invoice requirements based on the document “Production Report for the Shift”. We can say that the extract of the document “Demand-invoice” is the final document for registration of the business transaction “production”.

CHECKING THE WRITTEN OFF INVENTORY AND INVENTORY COSTS, COST DISTRIBUTION

Up to this point, we were registering transactions in 1C, but we still had no idea what actually happens to inventories of goods and materials, how they are written off, in what proportion the cost of goods and materials is transferred to finished products, and how additional costs affect the cost of products. The time has come to deal with these issues. Reports will help us with this.

All reports below can be found in the menu:

Report “Batch Statement”

Using this report, you can see a complete picture of the movement of the cost of inventory items. How materials and other supplies are converted into finished products, how the cost flow occurs.

As can be seen from the report, the cost of capitalized finished products is equal to the cost of writing off materials and electricity. So everything is correct. The only thing that needs to be taken into account when checking the cost price is that it needs to be checked and viewed after the document “Calculation of the cost price” has been carried out. It is this document that is responsible for “flows”. The cost calculation document is available in:

The cost calculation must be carried out on the last day of the month so that all documents are included in the calculation. The list of items that are allocated to cost can be added and reduced at your discretion.

Report "Cost Allocation Analysis"

This report shows approximately the same thing as the “Statement of batches of goods in warehouses” report, only here the specific linkage of materials to products is indicated. In the correct form, the sum of the “Costs” column should be equal to the sum of the “Output” column. If equality is not observed, it means that a mistake was made somewhere.

Report “Plan-actual analysis of production costs”

This report, in our opinion, is one of the most convenient for analyzing production costs. The structure of the report implies item-by-item analytics. In our case, the report includes direct material costs and energy costs. With this report, you can study what parts the cost of a product consists of, what specific costs and to what extent influence the final price of the finished product. Also, if you display an additional column “Price” in this report, then the report immediately shows the cost of a unit of manufactured products at cost. This price can be used to calculate the retail selling price or the break-even point of sales.

SALE

Actually, after we have produced the product, we can sell it to the buyer. Based on the buyer’s order, we create a document “Sales of goods and services” and post it. If anyone has forgotten, let us remind you that the document “based on 2” is created by right-clicking the bear – create based on... Item items from the order will be automatically transferred to the sales document. All that remains is to click OK. The sales document log is accessible from the menu:

Main menu - Documents - Sales management - Sales of goods and servicesAfter all this, you can sum up the financial results. In our case, we will summarize the financial results for one transaction.

FINANCIAL RESULTS

To analyze the financial results of activities, we will use the “Gross Profit” report. The report shows the profitability of business operations. Before displaying the results of the report, let us draw your attention to the complete subordination structure that we have, starting from the customer’s order and ending with the sale of products. This structure is correct from the point of view of the chain Order - Production - Sales.

Once again, we will re-run the “Calculation of cost” document so that the cost of production is written off for sale and only after that a profit report will be generated.

Gross Profit Report

The report shows that we performed positively, both in resale positions and in our own production positions.

Thus, we have concisely broken down the full cycle of production and sales in 1C UPP into components. Video material will soon be attached to the text article so that you can better understand the nuances of the 1C UPP program.

Step-by-step instructions for working with the business process Internal order, full cycle

Full Cycle Scheme

- Step 1. Working with the Internal Order document

- Step 2. Working with the Goods Reservation document

- Step 3. Working with the document Transfer of goods

- Step 5. Working with reports

- Step 6. Working with a Document Closing Internal Orders

Full Cycle Scheme

The full cycle from creating an Internal Order to Closing Internal Orders consists of the documents presented in Figures 1 and 2

Picture 1

Figure 2

General description of the business process using the example of the Customer (OP Kazan) and Contractor (OP Moscow).

The Internal Order document forms only the need of the applicant (for example, Kazan OP) to order goods from another warehouse (for example, in Moscow OP). The document Internal order does not reserve goodsManager from OP Kazan

The logistician/Manager in the Moscow OP determines, using the Analysis of Internal Orders report, how much of a certain product has been ordered by the department.

The logistician/Manager in the Moscow OP determines, based on the Analysis of Availability of Goods in Warehouses report, how much goods he can reserve for the Kazan OP.

From the Internal Order document, the manager in the Moscow OP forms a “Goods Reserve document” in his warehouse.

The movement indicates how much goods are planned to be shipped.

The Movement document is only recorded, but is not posted until the warehouseman has shipped the actual quantity using the Issue Note document.

If there is no need for the ordered product, in this case the document Closing internal orders is generated, which cancels the ordered product and resets the remaining reserve

Step 1. Working with the Internal order document

Where to find the document

Filling out the document

Paragraph 1 - The warehouse of the OP, who orders the goods from you, is filled in in the header of the document. In this case, the order defines the order type “To warehouse”.

Point 2 - You can also indicate the expected date of shipment in the header of the document. You can later use this information in reports.

- After holding the document, make sure that the document has movement, m Possible if you open a menu item in the document itself

Or you can use the Internal Order Analysis report

The report is generated for the period, in the “planned to ship” column it shows how much goods according to the internal order document were ordered by the Kazan OP to the Moscow OP

Step 2. Working with the Goods Reservation document

- Before using the Goods Reservation document, This must be determined using the “Product Availability Analysis” report withfree quantity that can be put into reserve

- After determining the free balance for reservation

We create a document Reservation of Goods based on the Internal order. To do this, open the document Internal order, menu item action-Reservation of goods.

- Fill out the created document Reservation of goods

When filling out the document in the tabular section, you must indicate column New placement Warehouse where it is necessary to produce Reservation

- After holding the document, make sure that the document has movement.

You can if you open a menu item in the document itself

Or you can use the Universal report

Select the required fields in the report as in the screenshot below.

The report is generated for the selected period

The “Receipt” column shows how much of the product was reserved according to the Internal Order document, and what is the remaining reserve for the selected date

Step 4. Working with documents Receipt and Disbursement order

- Before using the document Transfer of Goods

It is necessary to determine, using the “Item Availability Analysis” report, Items in reserve in warehouses to determine the free quantity that can potentially be moved.

Let's open the report Analysis of availability of goods in warehouses

Paragraph 1 The screenshot shows how many free tons there are goods are stored in the Moscow warehouse

Point 2shows how many reserved goods are in stock

Point 3 shows free balance without reserve

- We create a document Transfer of Goods based on the Internal order. To do this, open the document Internal order, menu item action-Movement of goods.

When creating a document, a form for selecting the sender's warehouse will open

The document is filled out, please note that the number of lines in the document automatically became 2 (two), although in the Internal Order document we indicated only one line with one item

The fact is that the document controls both the free balance and the balance in the reserve. The Accessibility Analysis report told us that

Remaining = 177 pcs.

Reserved = 100

Free balance = 77

In accordance with this, the document indicates that line No. 1 is filled from the reserve, and line No. 2 is filled from the free balance. If the Reserve Document attribute is not specified, this means a transfer from the free balance. If the “Reserve Document” detail is filled in, then during the move the reserve will be removed at the sending warehouse, Moscow OP.

In addition, you can add data from different Internal Order documents to the Transfer document

To do this, open the Fill menu item and select the Add by internal order item.

A selection form for different documents will open. Internal order

After filling out the Movement document, we write down the document, but do not post it, but only in select the printable form Transfer of goods

We print it out and give it to the storekeeper at the warehouse.

The warehouseman, when shipping the goods, indicates the actual quantity of goods that fit into the car

And returns the printed form to the Manager, who, based on the results of the shipment, corrects the document Movement that has not yet been posted and posts it.

Step 4. Working with the document Movement of goods

Outgoing and Incoming Orders do not generate movements in the register of goods in reserve in warehouses, therefore they do NOT affect the formation or removal of the reserve.

Step 5. Working with reports

Let's look at the reports to see what picture has developed in warehouses at the moment after the execution of Outgoing and Incoming Orders

The Goods in reserve in warehouses report shows that as of 03/29/13, 80 units are stored at the Moscow OP warehouse according to an internal order. goods.

The Goods in reserves in warehouses report shows more clearly which document was used to reserve the goods and remove them from the reserve; the reserve balance also includes 80 units. goods

Report Analysis of Internal Orders The report is designed to analyze the status of internal orders at a certain point in time.

- Paragraph 1- this is the quantity of goods indicated in internal orders

- Point 2- the total number of goods that remain to be fulfilled for the order.

- Point 3- the number of goods that are reserved in the warehouse.

- Point 4- the number of goods that should be additionally reserved. When calculating this quantity, the free balance of goods in the warehouse is not taken into account - it is assumed that the user independently decides on the use of the free warehouse balance.

In order to completely fulfill the order, we focus on column 2 Remaining to complete, Point 2 in the report Analysis of internal orders. And again we create the Movement and documents Incoming and Outgoing Orders, that is, we repeat step 2

If there is no need for the ordered product, in this case the document Closing Internal Orders is generated, which cancels the Ordered product and resets the remaining reserve

Step 6. Working with the document Closing internal orders

Prerequisites for the formation of the Document Closing internal orders

- when all goods for all reserves and placements have been received by the customer;

- when the customer refused to receive the order and removed all reserves and all placements;

- when you need to suspend work on an order and remove all reserves and placements for it

- We create a document Closing Goods based on an Internal Order. To do this, open the Internal Order document, menu item Action - Reservation of Goods.

The document is filled out automatically, all that remains is to post the document. After posting the document, you can make sure that the document has movements if you open the menu item in the document itself

In addition, it is possible to close using arbitrary Internal Order documents. This means that you can independently determine those documents for which the reserve and placement of internal orders is not relevant.

When you click the Fill button, a form opens that allows you to select documents Closing internal orders under certain conditions

- Paragraph 1- Set the period for selecting Internal orders

- Point 2- Selection conditions

- Point 3- The fill button finds the required documents according to the selection conditions.

- Point 4- The transfer button transfers the found internal order documents from the additional form to the main tabular part of the document

The selection conditions for Internal Order documents that you can set are:

- Random selection. Allows the user to independently determine all selection conditions, including those not available in other types of filling.

- Outdated orders. Orders that have not seen any movement for a long time are selected. Namely: there are no reserves and placements, there were no shipments, and the “statute of limitations” has expired. The expiration date is determined by the “shipment date” specified in the orders. The statute of limitations for legacy orders is default and can be changed by the user, ranging from 0 to 999 days.

- Completed orders. Those orders for which there are no balances for the shipment of goods and all reserves and placements are absent (removed) are considered fulfilled. It is considered that all work on such orders has been successfully completed and the orders are subject to closure.

The selection is made according to the following parameters: availability of reserves; placement of reserves (in warehouses/in orders); shipment status; Shipping date. In addition, it is possible to select by document details, as well as by properties and categories of details.

We post the document, look at the resulting structure of documents on using the Internal Orders subsystem